Our Services

Accounts

All small businesses are required to have an annual set of accounts prepared for tax purposes. The vast majority of small businesses don’t have the in-house knowledge or inclination to prepare their own accounts. Having prepared accounts for countless businesses over the last quarter of a century, we have developed an extensive understanding of the needs of our market. Our experienced team of accountants will prepare your accounts professionally, within agreed timescales and file your accounts with HMRC by the required deadlines.

Tax Returns

Paying tax on business profits is a fact of life. In our experience however, many businesses are simply not aware of how they can legitimately reduce the amount of tax they pay to HMRC. We always endeavour to ensure our clients are made fully aware of how they can legitimately reduce the amount of tax they pay. We’ll submit your annual accounts and any tax returns to ensure your business always remains HMRC compliant and only pays the correct amount of tax…and no more!

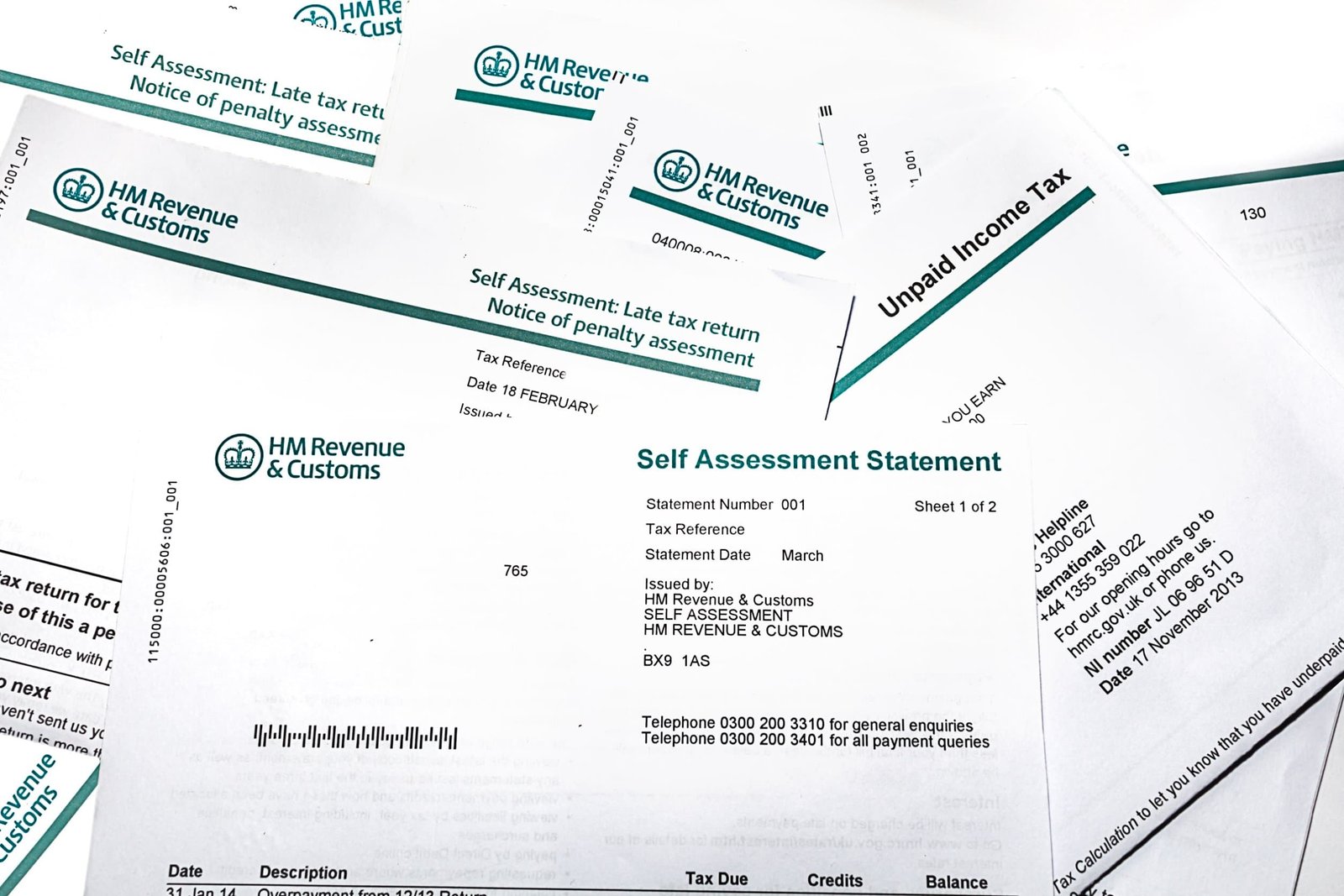

Self-Assessments

Individuals and Directors are usually required by HMRC to file Self-Assessments Tax Returns. Our experience shows most people choose to use professionals like ourselves with completion and filing of their Self-Assessments. Our Self-Assessment Teams are highly adept at undertaking this task for our Clients.

Bookkeeping

For small businesses, Bookkeeping can be both labour intensive and time consuming which is why the vast majority of our Clients use our Bookkeeping Teams to undertake this important task for them. Our Bookkeeping Teams are experts in using the most popular accounting software, e.g. Sage, Quickbooks, Xero, etc. Crucially, we also regularly review your entries to ensure their accuracy.

VAT Returns

Our in-house VAT experts have gained a vast amount of knowledge over the years covering all aspects of VAT. Our VAT service is used by a plethora of businesses in all key industries including Retail, Manufacturing and Service sectors. You can rest assured you’ll be in safe hands with our VAT filing services.

Payroll

Like Bookkeeping, Payroll is another service which the majority of our Clients outsource to us. Our Payroll Teams are highly experienced in managing the diverse Payroll requirements of our Clients in many different industries.

Tax Investigations

Any business which has undergone a Tax investigation by HMRC will know how worrying and problematic this can be. We have extensive experience of dealing with HMRC on behalf of our Clients in Tax investigations. We always have the interests of our Clients in mind and have successfully managed to negotiate on behalf of our Clients in reducing HMRC Tax demands.

Closing a Business

Sometimes unforeseen circumstances e.g. the Covid-19 Pandemic, economic downturns or even changes in personal and family circumstances can force businesses to face unplanned closure. Most people need help and advice in starting a business and the same is true for closing a business. There are various important tax and legal considerations to take into account when closing a business which is why we have helped many businesses go through this process in a quick and orderly manner.

Insolvency

Sadly, some businesses are made insolvent through trading or legal difficulties. Insolvency legislation is complex requiring expertise to manage the process correctly. For businesses in this predicament we can provide appropriate services to enable a smooth transition through this process.

Cash Flow Forecasts

All businesses need Cash Flow Forecasts to help them plan and budget their income and expenditure. We help businesses develop detailed and accurate Cash Flow Forecasts usually over one to five years, to help them manage their businesses more efficiently and effectively. We also assist businesses develop Cash Flows as they are usually required by Banks as part of their Loan Applications or requests for Overdraft facilities.

Business Plans

A robust and detailed business plan is a very important and strategic tool for all businesses. A comprehensive business plan helps entrepreneurs focus on the specific steps necessary for them to make business succeed. Business Plans also enable business owners to achieve key short-term and long-term goals and objectives. Banks usually always require businesses to supply their Business Plans as part of their Loan Application and requests for Overdraft facilities.